The global healthcare sector has witnessed a monumental shift in surgical procedures over the last few decades. Traditional open surgeries, which once dominated the operating room, are increasingly being replaced by minimally invasive surgeries (MIS). These techniques offer a variety of benefits, including faster recovery times, reduced pain, and minimal scarring, all contributing to their growing popularity. The minimally invasive surgical devices market is a crucial component of this transformation. In 2023, the market was valued at USD 27.18 billion, and it is projected to grow at a compound annual growth rate (CAGR) of 9.6%, reaching an anticipated value of USD 62.08 billion by 2032. This expansion is driven by a range of factors, including the increasing prevalence of chronic diseases, advancements in medical technologies, and a growing preference for outpatient surgeries.

In this detailed analysis, we will explore the current market landscape and provide an in-depth understanding of the key players involved. Specifically, we will focus on four major companies: Stryker, CONMED Corporation, Intuitive Surgical, and NuVasive, Inc., highlighting their contributions to the minimally invasive surgical devices market. Additionally, we will examine the factors driving growth, emerging trends, and the anticipated future of this sector.

1. Market Overview (2023)

1.1. Current Market Value

The global minimally invasive surgical devices market was valued at USD 27.18 billion in 2023. This valuation reflects the increasing adoption of minimally invasive techniques across various medical specialties, including orthopedics, gynecology, urology, and cardiology. A combination of technological advancements, patient preference, and cost-effectiveness has driven demand for these devices.

1.2. Major Drivers

Several factors contribute to the rising demand for minimally invasive surgeries:

- Growing Prevalence of Chronic Diseases: The rise in conditions like cardiovascular diseases, obesity, diabetes, and cancer has fueled the demand for surgeries. Minimally invasive options are becoming the standard of care, offering patients less invasive alternatives with quicker recovery times.

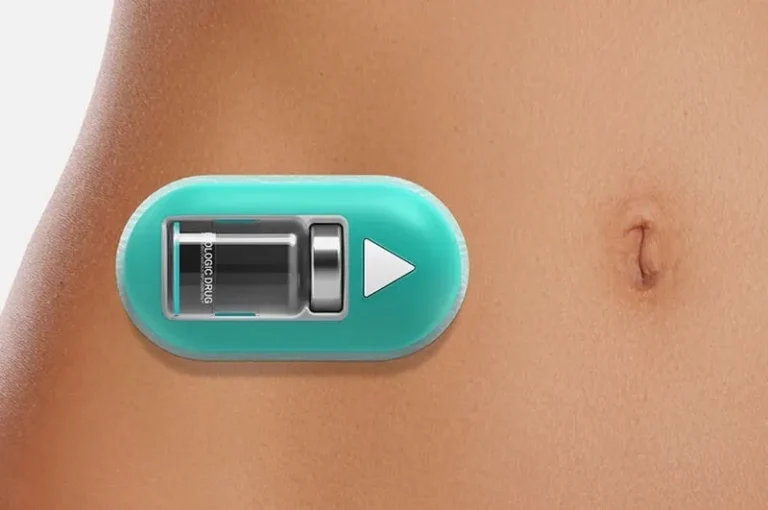

- Technological Advancements: Continuous improvements in imaging, robotics, and surgical instruments have enhanced the precision and safety of minimally invasive procedures. Innovations like robotic-assisted surgery and endoscopy have opened new possibilities in this field.

- Cost-Effectiveness: Minimally invasive surgeries often lead to shorter hospital stays, fewer complications, and quicker return to normal activities. This makes them an attractive option for both patients and healthcare providers looking to manage costs.

1.3. Market Forecast (2024-2032)

The market is expected to grow at a CAGR of 9.6% from 2024 to 2032, reaching an estimated value of USD 62.08 billion by 2032. This significant growth is expected to be driven by:

- Expanding Applications: MIS techniques are increasingly being used across a wider range of surgical procedures, including orthopedic, neurological, and thoracic surgeries.

- Aging Population: The global aging population is more susceptible to chronic conditions requiring surgical interventions, further increasing the demand for MIS.

- Healthcare Access: Expanding access to healthcare services in developing regions is expected to contribute to market growth as more patients undergo surgeries.

2. Key Market Players

The minimally invasive surgical devices market is highly competitive, with several major players driving innovation and growth. Let’s explore four key companies in detail:

2.1. Stryker

Stryker Corporation, a leading global medical technology company, has made significant strides in the field of minimally invasive surgical devices. With a diversified portfolio spanning multiple medical specialties, Stryker’s presence in the MIS market is particularly strong in orthopedics, neurotechnology, and spine surgery.

2.1.1. Product Offerings

Stryker’s offerings include a range of advanced surgical tools, imaging systems, and robotics:

- Mako Robotic-Arm Assisted Surgery: One of Stryker’s flagship innovations is the Mako system, used for joint replacement surgeries. This robotic-assisted platform provides surgeons with precise control and improved accuracy, leading to better patient outcomes.

- Endoscopy and Imaging Systems: Stryker’s endoscopy solutions are widely used in various laparoscopic procedures, offering high-definition imaging for better visualization during surgeries.

2.1.2. Strategic Initiatives

Stryker continues to invest heavily in research and development (R&D) to stay ahead in the rapidly evolving MIS market. Their acquisition strategy has been pivotal, as seen with their recent purchase of Wright Medical, which strengthens their position in the extremities and biologics markets.

2.1.3. Market Presence

Stryker’s extensive global presence, strong brand reputation, and innovative product portfolio have enabled it to maintain a leadership position in the MIS market. Their commitment to customer support and education for healthcare professionals further solidifies their standing.

2.2. CONMED Corporation

CONMED Corporation is a global medical technology company specializing in surgical devices and equipment. Known for its focus on minimally invasive procedures, CONMED’s products are widely used in orthopedic, general surgery, and gastroenterology.

2.2.1. Product Offerings

CONMED offers a comprehensive range of products for minimally invasive surgery, including:

- Arthroscopy Devices: CONMED’s arthroscopy solutions are designed for precision in sports medicine and orthopedic surgeries. Their shaver systems, fluid management systems, and visualization tools are widely used.

- Advanced Energy Products: The company’s advanced energy portfolio, which includes electrosurgical generators and smoke evacuation systems, is integral to various laparoscopic and endoscopic procedures.

2.2.2. Strategic Initiatives

CONMED focuses on continuous innovation and partnerships to enhance its product offerings. Recent investments in its R&D capabilities have led to the development of novel energy-based solutions for improved surgical outcomes.

2.2.3. Market Presence

With a strong presence in both developed and emerging markets, CONMED continues to expand its reach. Their dedication to surgeon training and education has built a loyal customer base, particularly in the orthopedic and sports medicine sectors.

2.3. Intuitive Surgical

Intuitive Surgical is synonymous with robotic-assisted surgery, largely due to its groundbreaking da Vinci Surgical System. The company has revolutionized MIS by combining robotics with minimally invasive techniques, particularly in urology, gynecology, and general surgery.

2.3.1. Product Offerings

Intuitive Surgical’s da Vinci platform has set the standard for robotic-assisted MIS:

- da Vinci Surgical System: The da Vinci system allows surgeons to perform complex procedures with enhanced precision, flexibility, and control. The system’s 3D-HD vision, combined with its robotic arms, offers unparalleled accuracy in minimally invasive surgeries.

- Instruments and Accessories: Intuitive Surgical also offers a wide range of instruments and accessories specifically designed for use with the da Vinci system, further enhancing its capabilities.

2.3.2. Strategic Initiatives

Intuitive Surgical continues to push the boundaries of robotic surgery through ongoing R&D efforts. The company has also focused on expanding the da Vinci system’s applicability to more surgical procedures, including thoracic and colorectal surgeries.

2.3.3. Market Presence

Intuitive Surgical’s dominance in the robotic surgery space is evident in its widespread adoption in hospitals and surgical centers worldwide. Its focus on training programs and partnerships with healthcare institutions has bolstered its reputation as a leader in the field.

2.4. NuVasive, Inc.

NuVasive, Inc. is a medical device company focused on developing minimally disruptive surgical solutions for the spine. The company’s innovative products and techniques have revolutionized spine surgery, offering less invasive options for treating various spinal conditions.

2.4.1. Product Offerings

NuVasive’s product portfolio is centered around minimally invasive spine surgery:

- XLIF (eXtreme Lateral Interbody Fusion): XLIF is a minimally invasive surgical technique developed by NuVasive, allowing for spine surgery through smaller incisions and less tissue disruption.

- NuVasive Pulse Platform: The Pulse platform integrates various technologies, including imaging, navigation, and robotics, to improve the precision and efficiency of spine surgeries.

2.4.2. Strategic Initiatives

NuVasive has consistently invested in R&D to expand its minimally invasive spine surgery portfolio. Recent collaborations with other medical technology companies have allowed NuVasive to integrate robotics and navigation technologies into their surgical solutions.

2.4.3. Market Presence

NuVasive’s focus on providing surgeon education and training, combined with its innovative product offerings, has made it a leader in minimally invasive spine surgery. The company continues to grow its presence in international markets through strategic partnerships and product launches.

Get a Free Sample Report with Table of Contents

3. Key Trends and Future Outlook

The future of the minimally invasive surgical devices market looks promising, with several key trends expected to shape its trajectory:

3.1. Rise of Robotic-Assisted Surgery

Robotic-assisted surgery is rapidly gaining traction, offering improved precision and control for complex procedures. The integration of artificial intelligence (AI) and machine learning (ML) into robotic systems is expected to enhance surgical outcomes further.

3.2. Increased Focus on Outpatient Surgeries

The shift toward outpatient surgeries is likely to continue, driven by advancements in MIS technologies that allow patients to recover faster and avoid extended hospital stays. This trend is expected to reduce healthcare costs and increase patient convenience.

3.3. Expanding Applications of MIS

Minimally invasive techniques are being applied to a broader range of surgical procedures, including those in neurology, cardiology, and thoracic surgery. As MIS becomes the preferred approach in more specialties, the demand for related devices will grow.

3.4. Technological Advancements

Advancements in imaging technologies, such as augmented reality (AR) and virtual reality (VR), are expected to enhance the capabilities of MIS. These innovations will allow surgeons to visualize complex anatomical structures more accurately, leading to better surgical outcomes.

3.5. Growth in Emerging Markets

As healthcare infrastructure improves in emerging markets, the adoption of minimally invasive surgical devices is expected to increase. Countries in Asia-Pacific, Latin America, and the Middle East are likely to see significant growth, driven by rising healthcare spending and increasing awareness of MIS benefits.