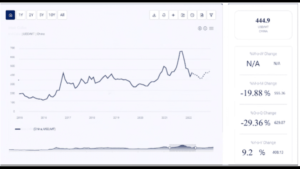

The United States label release liner market value reached USD 1.83 billion in 2023. The market is expected to grow at a CAGR of 5.5% during the forecast period of 2025-2033, reaching approximately USD 2.96 billion by 2033. In this blog, we delve into the market dynamics and explore the growth trajectory, recent developments, challenges, and future opportunities for stakeholders.

Market Overview

Label release liners are crucial components in the labeling process, serving as carriers for adhesive labels before application. These liners are widely used across diverse industries such as food and beverages, pharmaceuticals, cosmetics, and industrial goods. With increasing demand for efficient labeling solutions driven by e-commerce growth and stringent regulations, the market has been on a steady upward trajectory.

The push for sustainable and recyclable materials is reshaping the industry, with companies investing in eco-friendly alternatives to cater to changing consumer and regulatory demands.

Market Size

The label release liner market in the United States was valued at USD 1.83 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.5% through 2033. Factors such as increasing automation in labeling processes and the expansion of industries like pharmaceuticals and packaged foods have contributed significantly to this growth.

The adoption of high-performance film-based liners and advancements in liner recycling technologies also play a pivotal role in driving the market’s expansion.

Market Share

By Material Type

- Paper-Based Liners:

These hold a significant share of the market due to their cost-effectiveness and recyclability. They are predominantly used in food and industrial labeling. - Film-Based Liners:

Film-based liners are gaining traction due to their superior durability and moisture resistance. Industries like pharmaceuticals and cosmetics, which require precise and tamper-proof labels, prefer these liners.

By Application

- Food & Beverages: The largest segment, driven by increasing packaged food demand and the need for compliant labeling.

- Pharmaceuticals: A rapidly growing segment, necessitated by strict labeling regulations and safety requirements.

- Cosmetics and Industrial Goods: These sectors are steadily adopting high-quality and innovative labeling solutions.

Market Trends

1. Rising Demand for Sustainable Solutions

Environmental concerns and stringent government regulations are driving the shift toward recyclable and biodegradable label release liners.

2. Technological Advancements

Innovations in coatings and adhesives are enhancing liner performance, enabling faster and more efficient application processes.

3. Customization

Demand for customized liners tailored to specific industry needs is on the rise, particularly in sectors like cosmetics and e-commerce.

4. Increasing Adoption of Film-Based Liners

The durability and performance of film-based liners make them a preferred choice in high-end applications.

Market Analysis

SWOT Analysis

- Strengths: High demand from diverse industries, advancements in material science, and established market players.

- Weaknesses: High production costs for sustainable materials and limited recycling infrastructure.

- Opportunities: Growth in e-commerce and increased focus on brand differentiation through labeling.

- Threats: Competition from alternative labeling technologies such as linerless labels.

Porter’s Five Forces Analysis

- Threat of New Entrants: Moderate, due to the capital-intensive nature of manufacturing and R&D.

- Bargaining Power of Buyers: High, as buyers seek cost-effective and innovative solutions.

- Threat of Substitutes: Moderate, with competition from emerging labeling technologies.

- Bargaining Power of Suppliers: Moderate, influenced by raw material price fluctuations.

- Industry Rivalry: High, with several established players competing on innovation and sustainability.

Market Segmentation

By Material

- Paper-Based Liners: Cost-efficient and environmentally friendly, these are widely used in food and industrial labeling.

- Film-Based Liners: Preferred for high-performance applications due to their strength and moisture resistance.

By Application

- Food & Beverages: High usage for labeling products in compliance with safety and quality standards.

- Pharmaceuticals: Increasing demand for precision and regulatory compliance.

- Cosmetics: Premium labeling solutions for branding and aesthetic appeal.

- Industrial Goods: Used for durable goods and logistics labeling.

Market Growth

The market is poised for significant growth, driven by:

- Rising e-commerce demand for logistics labeling.

- Increased investment in sustainable materials by major players.

- Technological advancements that enhance the efficiency of labeling processes.

- Expanding applications in the pharmaceutical sector due to stringent regulatory requirements.

Recent Developments and Challenges in the Market

Recent Developments:

- Introduction of eco-friendly and biodegradable liner materials.

- Partnerships and collaborations among major players to expand product portfolios.

- Advancements in recycling technologies for used liners.

Challenges:

- High production costs associated with sustainable and innovative materials.

- Limited infrastructure for recycling label release liners.

- Rising competition from linerless labeling and other alternative technologies.

Key Players in the Market

The competitive landscape of the U.S. label release liner market includes several prominent players who contribute significantly to innovation and market growth:

- 3M Company

- Avery Dennison Corporation

- UPM Raflatac

- Loparex

- Sappi Limited

These companies are focusing on R&D, strategic partnerships, and eco-friendly product launches to maintain their competitive edge.

Upcoming Challenges in the Market

The U.S. label release liner market faces several challenges:

- Sustainability Requirements: Rising environmental regulations require companies to adopt eco-friendly practices.

- Cost Management: Balancing innovation with cost-effectiveness remains a critical challenge for manufacturers.

- Raw Material Volatility: Price fluctuations of raw materials impact profit margins.

- Technological Disruption: Competition from emerging technologies such as direct thermal labeling could pose a threat.

Competitive Landscape

The market is highly competitive, with established players investing heavily in innovation and sustainability. New entrants face challenges due to high capital requirements and the dominance of major players. The focus on recyclable and biodegradable liners will likely intensify competition in the coming years.

The U.S. label release liner market is set to witness substantial growth over the forecast period, driven by advancements in technology, rising demand for sustainable solutions, and the expanding applications of labeling across industries. While challenges such as cost pressures and competition from alternative technologies persist, the market offers immense opportunities for innovation and expansion. Stakeholders must focus on sustainability, innovation, and customer-centric solutions to succeed in this dynamic market.